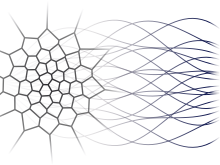

We present here the quantization method which is well-adapted for the pricing and hedging of American options on a basket of assets. Its purpose is to compute a large number of conditional expectations by projection of the diffusion on optimal grid designed to minimize the (square mean) projection error ([24]). An algorithm to compute such grids is described. We provide results concerning the orders of the approximation with respect to the regularity of the payoff function and the global size of the grids. Numerical tests are performed in dimensions 2, 4, 6, 10 with American style exchange options. They show that theoretical orders are probably pessimistic. |